AMERICAN MONETARY INSTITUTE

Tel. 224-805-2200, ami@taconic.net

http://www.monetary.org

PRESS

RELEASE– IMF (International Monetary Fund) Division Chief

Speaks in Chicago.

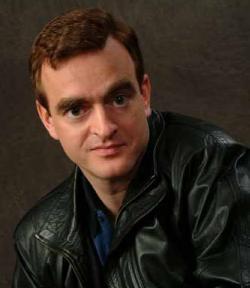

Dr.

Michael Kumhof, the Deputy Division Chief of the modeling Division,

of the Research Department of the International Monetary Fund of

Washington, DC, will address a monetary reform conference in Chicago

on the results of computerized "modeling" (mathematically

predicting the results) of the Chicago Plan proposal,

which came out of the University of Chicago in

the 1930s to end the Great Depression. Kumhof

applies it to the modern

U.S. financial system. This is the first time that such an exercise

has been done. See:

The

Chicago Plan was designed and promoted by our best economists in the

1930s (Henry Simons, Irving Fisher, Douglas, et al), to get

our nation out of the Great Depression. It would nationalize the

private Federal Reserve System; our money supply would only be

created by the government; and it decisively ended what’s called

“fractional Reserve banking.” It is the model for

Congressman Dennis Kucinich's "NEED Act" (National

Emergency Employment Defense Act), presently introduced in the 112th

Congress as "HR 2990."

Kumhof

presents the results of his study at the 8th annual

American Monetary Institute Conference, at University Center in

Chicago, at 9:30 AM on Friday, September 21st.

The

study concludes that:

“The

Chicago Plan could significantly reduce business cycle volatility

caused by rapid changes in banks’ attitudes towards credit risk, it

would eliminate bank runs, and it would lead to an instantaneous and

large reduction in the levels of both government and private debt. It

would accomplish the latter by making government-issued money, which

represents equity in the commonwealth rather than debt, the central

liquid asset of the economy, while banks concentrate on their

strength, the extension of credit to investment projects that require

monitoring and risk management expertise.…This ability to generate

and live with zero steady state inflation is an important result,

because it answers the somewhat confused claim of opponents of an

exclusive government monopoly on money issuance, namely that such a

monetary system would be highly inflationary. There is nothing in our

theoretical framework to support this claim. And as discussed in

Section II, there is very little in the monetary history of ancient

societies and Western nations to support it either.”

Contact

Person: Stephen Zarlenga, Director, American Monetary Institute,

For

details on the conference see

http://www.monetary.org/2012schedule.html

Nessun commento:

Posta un commento